By STAN CHOE AP Business Writer

NEW YORK (AP) — Stocks climbed on Wall Street at the opening of trading Wednesday. Maybe this time it will last.

A big gain for the S&P 500 suddenly vanished the day before, and trading remained unsettled around the world Wednesday. Asian stock markets were mixed and European indexes fell.

The S&P 500 was up 0.6% after the first 20 minutes of trading. The Dow Jones Industrial Average rose 170 points, or 0.7%, to 22,813 and the Nasdaq was up 0.6%.

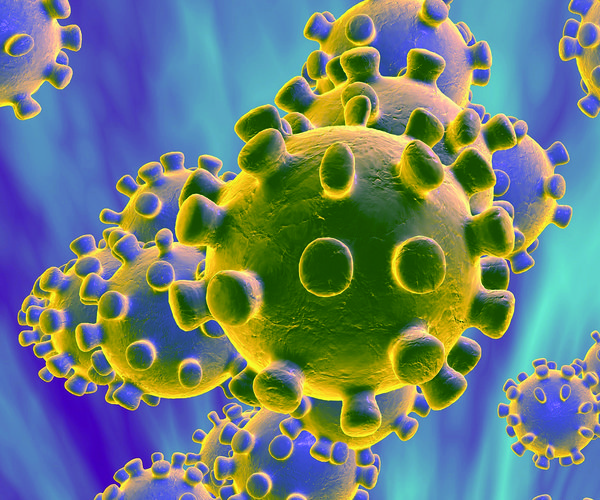

Markets have been incredibly volatile in recent weeks as investors blindly guess how badly the coronavirus outbreak will hurt corporate profits amid suffocating uncertainty. The economic damage is widespread, and France's central bank said its economy entered a recession with a 6% drop in the first three months of the year.

Countering that has been unprecedented aid from governments and central banks. Some investors are also pointing to nascent signs that infections and deaths may soon be peaking or plateauing in several hotspots around the world.

Caught between those forces are investors, who have sent the S&P 500 down about 20% from its record set in February. Earlier, it had fallen as much as a third from that mark, reflecting investors' expectations for a steep, sudden recession and drops in corporate profits. Where stocks go from here depends on how long it takes for the economy to reopen and get closer to what used to be normal.

Stocks that have been beaten down the most since the sell-off began in February were leading the market Wednesday, including energy companies, retailers, airlines and other travel-related companies. That was also the early trend of Tuesday, before the gains vanished.

Kohl's rose 8.5%, Noble Energy rose 8% and American Airlines Group was up 6%, though all three are still down more than 60% for 2020 so far.

Treasury yields, which signaled worries about the economic damage coming from the coronavirus outbreak earlier than the stock market, were relatively steady. The yield on the 10-year Treasury rose to 0.75% from 0.73% late Tuesday.

European stocks dipped as finance ministers clashed over a proposal to borrow as a collective to pay for the health crisis. Countries that have been hardest hit there by COVID-19 are also among those that can least afford to pay for it, such as Italy and Spain. But the outbreak is dragging on economies across the continent. German economists predict its economy will shrink 4.2% this year.

Germany's DAX slipped 0.2%, and France's CAC 40 fell 0.6%. The FTSE 100 in London lost 0.7%.

Trading in Asia was more mixed.

Japan's Nikkei 225 rose 2.1%, while stocks in South Korea fell 0.9% and Hong Kong lost 1.2%.

Benchmark U.S. crude oil rose 82 cents to $24.45 a barrel Wednesday, recovering some of its 9% slide from the prior day. Oil prices have been even more volatile than stocks recently as Russia and Saudi Arabia argue about whether to cut production in the face of withering demand. Oil producers are set to meet on Thursday.

Brent crude, the international standard, gained 20 cents to $32.07.

While many investors are preoccupied with the pandemic, energy remains another major factor driving trading.

Even Thursday's meeting was in doubt after Iran demanded greater clarity on the scale of U.S. oil production before talks can start.

For "more immediate market stability concerns, all eyes and ears remain trained on the success of the OPEC+ meeting on Thursday," Stephen Innes of AxiCorp said in a commentary.